De Blasio Quiet On Whether City Will Tax Second Homes of Supremely Wealthy, Oligarchs

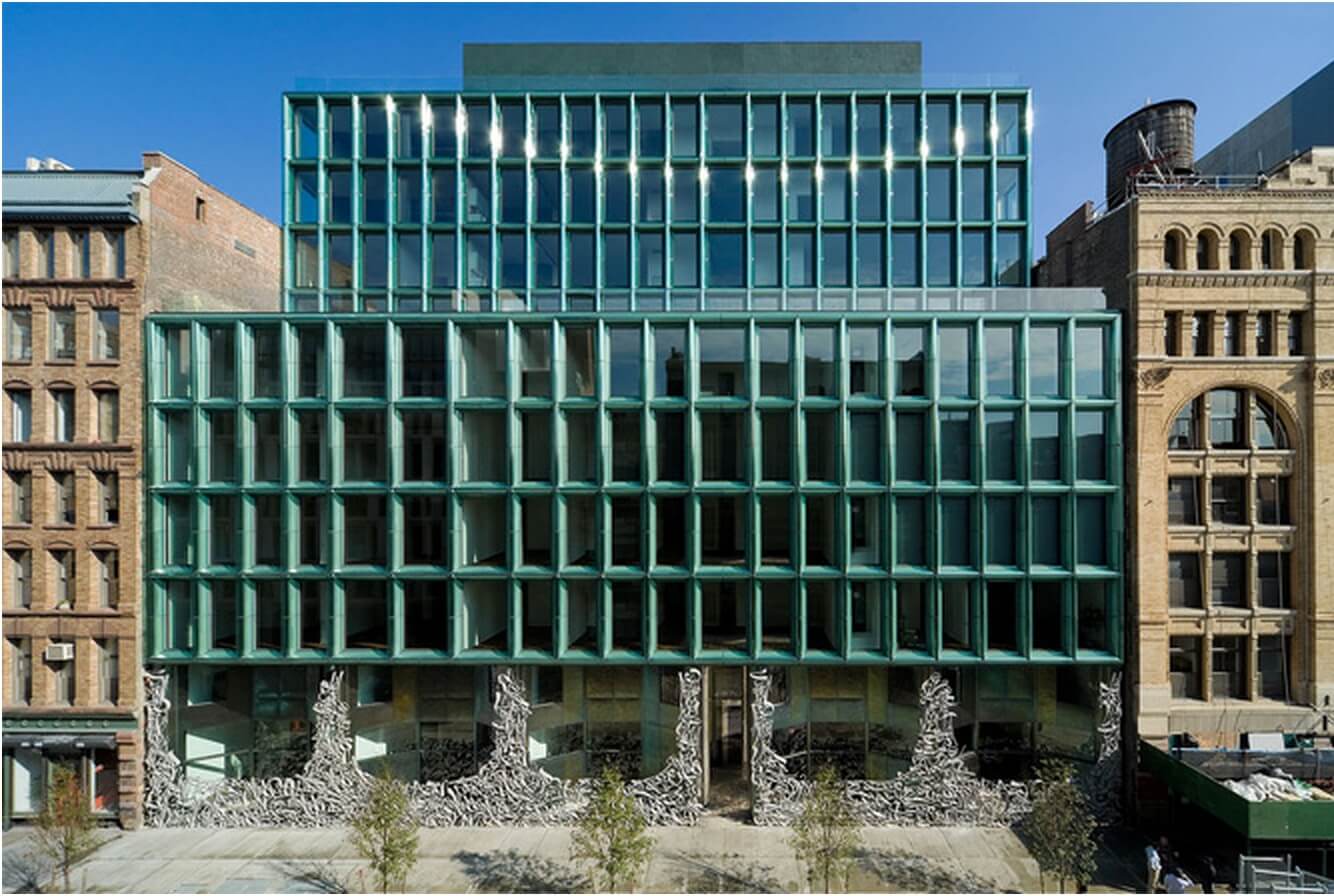

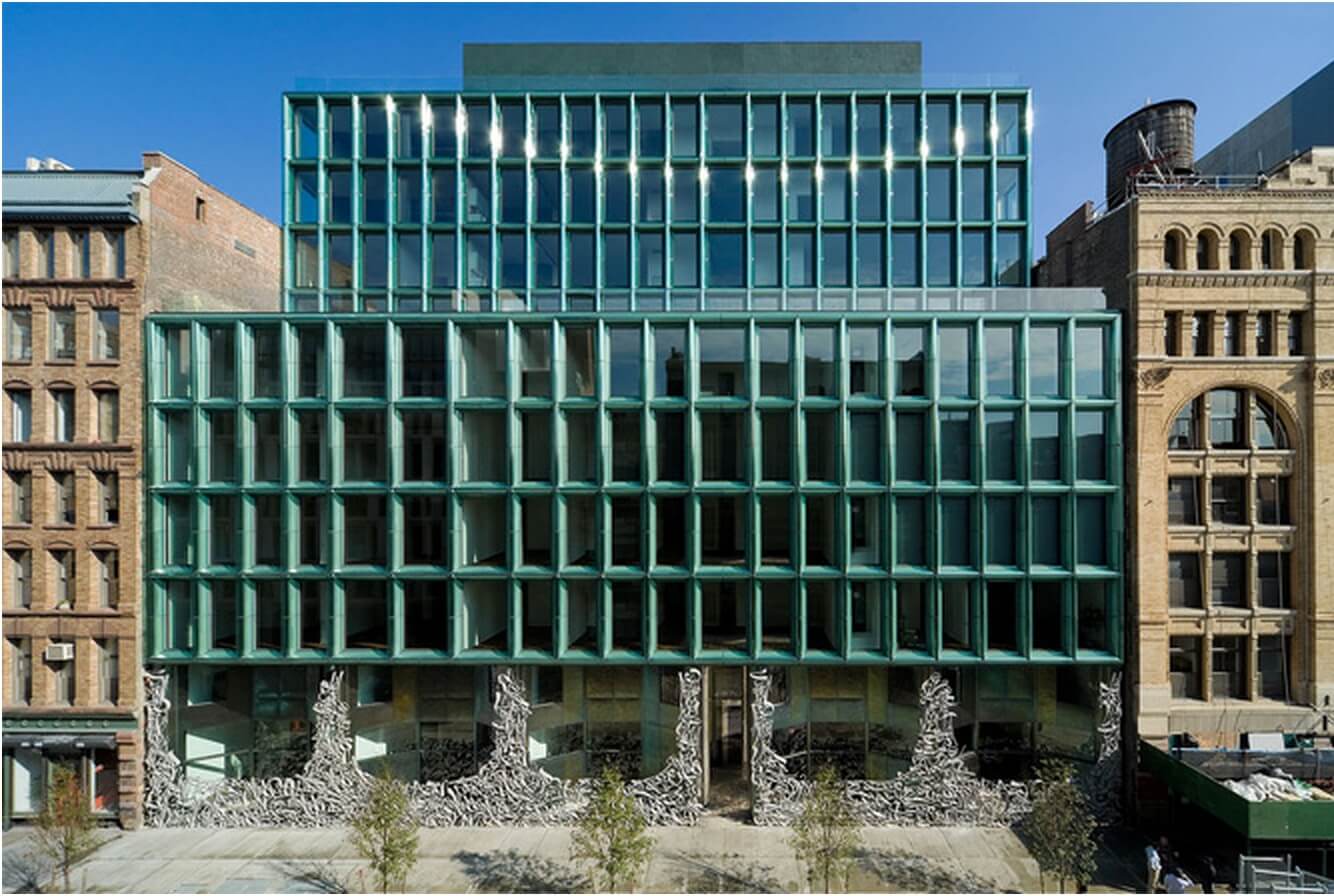

(Photo: Herzon & deMeuron)

Yesterday the Post reported the de Blasio administration plans to pass on supporting a measure to levy a special pied-a-terre tax on second homes in New York City.

The bill put forth by State Senator Brad Hoylman (a Democrat repping Manhattan’s 27th district, which includes Chelsea, the West Village, and parts of Midtown and the East Village) assigns a progressive tax on non-primary residence properties worth $5 million and up. The tax would apply to single family occupancy homes, condos, and co-ops in any city in New York state with a population of at least one million.

Property owners of non-primary residences worth between $6 million and $10 million would pay just $5,000 extra a year plus 1 percent of the excess tax imposed by their district. The highest tax bracket is for properties worth $25 million or more– owners would have to pay $370,000 plus 4 percent of excess. The bill is not directly aimed at foreign nationals necessarily, but it does reference “out-of-state” buyers.

According to the Furman Center for Real Estate and Urban Policy at NYU, the property tax burden in New York City is distributed unevenly. Shocker! In 2011, single family homes and condos in buildings four stories and under accounted for nearly half of the city’s entire property market value, though property owners were only paying 15 percent of the property taxes. The city’s property tax on single family to three family homes is one of the lowest in the United States.

The tax system, as it is now, privileges home owners over renters. According to the Furman Center, this is something of a holdover from the late 70s and early 80s, when New York City was in economic turmoil and was in the business of convincing residents to stay. Reform, like the pied-a-terre tax, would help shift some of the burden back on to home owners and the supremely wealthy (those who pay only 15 percent of property taxes).

As the Times reported in late October, many of these non-primary residences are empty most of the year:

“In a three-block stretch of Midtown, from East 56th Street to East 59th Street, between Fifth Avenue and Park Avenue, 57 percent, or 285 of 496 apartments, including co-ops and condos, are vacant at least 10 months a year.”

Over the summer, when I found myself tagging along with some brokers to view some run-of-the-mill, barf-worthy $23,000/month bi-level apartment in NoHo, we stepped out onto the pristine white and glass balcony to check out the view–the back end of the notorious 40 Bond Street building. We got a somewhat creepily detailed peek inside the $7.5 million+ apartments across the way. I saw only one person moving about, a maid. The brokers assured me that those apartments were nearly always empty, properties purchased by people who want to own a piece of architecture, as if it were a painting.

Given the fact that most of the time these places are empty, it’s not a stretch to believe that many of these homes are a safe way for super fucking rich oligarchs and stateless billionaires to stash some cash in a place where, as non-primary residents, they don’t have to pay income tax.

Some real estate agents have argued the proposed pied-a-terre tax is unfair because non-primary residents don’t take advantage of city services in the same way that, you know, normal residents of the city do. Others project an “immediate chill” in the real estate market.

But maybe that wouldn’t be such a bad thing. Now that Brooklyn is the most unaffordable place in America to buy a home (in a study matching median-income makers with median-priced homes, potential buyers would have to allocate 98 percent of their income to afford a payment on that home). Basically, Brooklyn’s middle class couldn’t dream of buying an average home here.

So perhaps taking the market down a notch wouldn’t actually be such a terrible thing?

Despite the Post‘s report, supporters of the proposed legislation shouldn’t lose hope in gaining de Blasio’s backing just yet. Yesterday Gothamist got in touch with the Mayor’s Office and the press secretary responded that they have yet to take a position, and are still in the process of “developing the legislative agenda for the upcoming season in Albany.” Stay tuned.

You might also like